The vibrant marine world invites you to witness the shiny fins, swift moves and colourful creatures. Aquariums in India successfully create intrigue for all age groups. That’s exactly why visiting them keeps you entertained during your trips. Whether it is witnessing the catfish or walking through the underwater tunnel, you can do it all!

Visiting aquariums in India allows you to dive deeper into the world that lies beneath the seas and oceans. For your ease, here’s a list of different aquatic galleries across India. Now that you have access to the latest information, plan your journey soon. Also, remember to photograph your memories!

12 Amazing Aquariums in India are –

1. Under The Sun Aquarium, Udaipur

The marine life in Udaipur is here to please you! Get ready for an immersive experience at one of the best aquariums in India. Under the Sun Aquarium is popularly known for its expansive collection of fish. You can spot catfish, clownfish, angelfish and a lot more colourful ones. It is best to book affordable hotels in Udaipur for a hassle-free experience.

What makes this place special is the availability of different aquatic species and coral reefs. Moreover, the display of structured information enhances knowledge during your visit. If relaxing with fish is your thing, you can opt for fish pedicures here. Cleanse your feet and take home giggling memories.

Well, there’s more to this amazing place. It offers a virtual reality experience and takes you deep into the marine world. Right from spotting common fish to spotting sharks, VR makes it attractive for tourists and locals. The place also has an in-house restaurant. Do not forget to buy creative souvenirs from the gift shop here.

Entry Fee: INR 140 to INR 160

Location: Fateh Sagar Overflow, Fateh Sagar Lake, Udaipur, Rajasthan 313001

2. Namma Bengaluru Aquarium, Bengaluru

Previously known as the Government Aquarium, it is now owned by a private entity. Hence, the name is now changed to Namma Bengaluru Aquarium. It has a plethora of vibrant fish spread across two floors. Moreover, tourists love to talk about the hygiene and cleanliness levels here.

Being one of the most visited aquariums in India, it is known for its decorative space. The natural habitat for marine life makes it a positive place for the ecosystem. Additionally, the aquarium also has a beautiful pond for koi fish. The place intrigues you in distinctive ways. Also, book budget-friendly hotels in Bangalore for your trip!

To reach the exhibits, you need to walk through a tunnel, thereby making your journey interesting. It also has an amphitheatre for discovering more about marine life. With advanced technology, you can find a unique QR code with every exhibit. You can easily scan the code to learn more about it. Now that you’re in Bengaluru, you might also visit the famous museums to add to your intrigue.

Entry Fee: INR 118 for Adults | INR 47 for Children

Location: XHGX+JC3, Kasturba Rd, Shanthala Nagar, Bengaluru, Karnataka 560001

3. Sagarika Marine Research Aquarium, Kovalam

When in Kovalam, you cannot miss visiting the famous Sagarika Marine Research Aquarium. While this is a small place, it is indeed a great place to learn about marine life. After all, you must learn about the underwater world while in the coastal town. It is an aquarium with multiple fish, including koi, clownfish, sharks, starfish and giant sea turtles.

If you are travelling with kids, it is one of the best aquariums in India to keep them entertained. You also get an opportunity to learn about marine life, their existence, food and habits, unique features and a lot more. Every exhibit has information, making it easier to absorb knowledge. You need to pay INR 10 for mobile photography and INR 20 for the camera. Affordable hotels in Kovalam are certain to elevate your stay!

Entry Fee: INR 20 for Adults | INR 10 for Children

Location: Near Light House Road, Vizhinjam Harbour Road, Kovalam, Kerala 695521

4. VGP Marine Kingdom, Chennai

Welcome to one of the biggest aquariums in India! Yes, VGP Marine Kingdom in Chennai is a massively beautiful place to dive into the world of marine life. The place is loved by locals and tourists as you get to see life-sized tanks for the best view. It also showcases how well the aquarium takes care of delicate fish and other species!

Along with the display of the aquatic world, the aquarium tops in the case of design too. Every corner is designed in a unique way to showcase the environments preferred by different fish. You can discover the rainforest area and then go to gorges, mangroves, coastal areas and deep ocean areas.

A surprise awaits you here! The aquarium offers scuba diving experiences inside a large pool. Dive with the sharks and witness marine life in a fairly comfortable way. It also has an underwater tunnel, making it a cheerful attraction for little ones. Wear your gear and get ready for a thrilling journey. Make sure to book pocket-friendly hotels in Chennai for a comfortable time.

Entry Fee: INR 745 for Adults | INR 645 for Children

Location: SH 49, Injambakkam, Chennai, Tamil Nadu 600115

5. Marine Aquarium & Regional Centre, West Bengal

Get ready to experience the wonders of marine life in West Bengal. Near the beach is the famous Marine Aquarium and Regional Centre. The aquarium is known for its great display of marine species. You can spot a plethora of fish inside the place. It is important to note that photography is strictly prohibited here.

While the aquarium is small, kids still love to explore the marine world here. Interestingly, it also has the skeleton of the whale, which was once found in Digha. Every exhibit also offers basic information about the marine species, thereby making it ideal for little ones. It sure is one of the decent aquariums in India for a happy marine journey.

Entry Fee: Free

Location: JGF9+244, SH 57, Gadadharpur, Digha, West Bengal 721428

6. Marine World Public Aquarium, Kerala

Smiling stingrays are sure to make your day here at Marine World Public Aquarium. Being one of the largest public aquariums in India, you have to check this one. The aquarium is renowned for its apt maintenance and expansive collection of fish. It houses more than 3 lakh marine species with 300+ types of fishes.

Whether you are a marine enthusiast or simply wish to explore the marine world, this place has to be on your list. Some of the famous sightings include stingrays, piranhas, silver alligator gar, lionfish and lobsters. Starfish and eels are also a part of the family here.

Marine World Public Aquarium is all about extraordinary experiences. It has a cylinder aquarium where you literally feel being inside the waters. Moreover, you can walk on the glass bridge or even be a part of feeding sessions. An underwater tunnel, touch pools, fish spa and artificial forests truly elevate your time here. The place also has a 16D cinema, a live fishing area and a bird’s park.

Have some time in hand during the trip? The backwaters of Kerala might be ideal for a relaxing time.

Entry Fee: INR 400 for Adults | INR 280 for Children

Location: Panchavadi Panchavadi Beach, Kerala 680515

7. Aquatic Gallery – Science City, Ahmedabad

Step into the world of oceanic blue as you visit the popular Aquatic Gallery in Science City. Being one of the biggest aquariums in India, it attracts people from all walks of life. The aquatic gallery features nearly 10,000+ fish and other aquatic creatures.

Life-sized tanks make it habitable for fish to enjoy their time in the aquarium. What’s more? There are multiple touch-interactive exhibits for an entertaining time. Kids are certain to love the collection of fish ranging from the common koi to catfish, starfish and angelfish. The aquarium is divided into different zones based on the location: Indian, Asian, African and so on.

A mesmerising time awaits you here as you walk through the underwater tunnel. After the walk, visit the 5D theatre and discover the secrets of marine life! The place also has a themed cafe for satisfying your cravings. End your aquarium tour by browsing through the souvenir shop here. Also, book your stay at one of the affordable hotels in Ahmedabad for a great time.

Entry Fee: INR 200 Per Person

Location: Science City Rd, Science City, Bhuyang Dev, Sola, Ahmedabad, Gujarat 380060

8. Varkala Aquarium, Kerala

When in Varkala, do visit one of the decent aquariums in India. Varkala Aquarium is a great place if you are looking for a tranquil experience. Witnessing the fish glide from one place to another is surely therapeutic. Located near Black Beach, this aquarium has multiple common species of fish.

You also get an opportunity to spot sea turtles here! Moreover, the space is clean, making it a plus point for tourists. Surrounded by lush gardens, it is worth a one-time visit. The collection here is common, which is well-justified considering the minimal entry fee.

Entry Fee: INR 30 for Adults | INR 15 for Children

Location: PMWX+55Q, Odayam Hatchery, Thiruvambadi Beach, Varkala, Kerala 695141

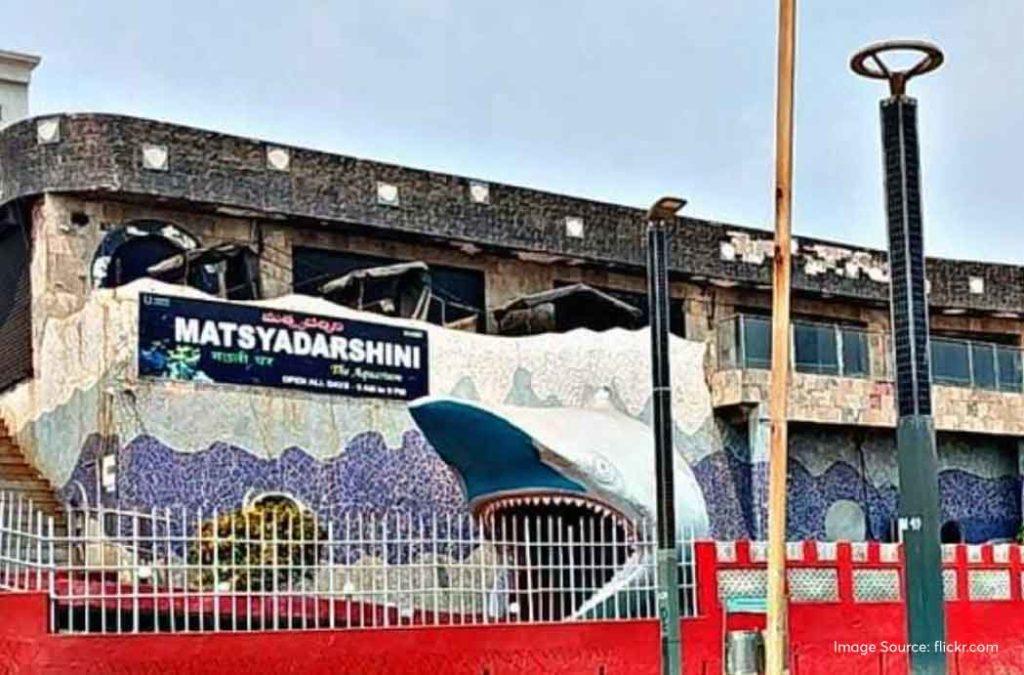

9. Matsya Darshini, Visakhapatnam

You know you are near Matsya Darshini as soon as you spot a massive shark with its open mouth! It is one of the best aquariums in India for a decent journey. The aquarium is known for its impressive collection of fish. Moreover, you can also spot sea turtles here.

While some enclosures need a bit of maintenance, visiting them with kids is sure to be entertaining. What’s more? The place has multiple exhibits with information available to all. You can also find a variety of informative displays offering knowledge about the marine world. Also, finding a great stay is no longer a hassle. Check out the best hotels in Visakhapatnam and choose as per your preferences.

Entry Fee: INR 50 for Adults | INR 20 for Children

Location: P87C+32X, Dr NTR Beach Rd, Chinna Waltair, Pandurangapuram, Visakhapatnam, Andhra Pradesh 530003

10. Jagdishchandra Bose Aquarium, Surat

An aquatic gem is right in the heart of Gujarat. Jagdishchandra Bose Aquarium in Surat is one of the most popular aquariums in India. This two-storey place is home to a plethora of marine creatures. You can also spot sea turtles, coral reefs and amphibians.

Since the previous aquarium was destroyed by floods, this one was made with sincere efforts to provide knowledge. What’s more? From stingrays, koi fish, starfish and angelfish, kids are certain to fall in love. Additionally, structured information makes it easy to learn about the marine world.

The aquarium follows eco-friendly practices to inspire visitors as well. Do not forget to take pictures of the fountain right outside the building! So, book budget-friendly hotels in Surat and spend your savings on exploring the city.

Entry Fee: INR 100 for Adults | INR 40 for Children

Location: Veer Vinayak Damodar Savarkar Flyover, opp. STAR BAZAR, Jalaram Society, Adajan Gam, Adajan, Surat, Gujarat 395009

11. Lokaranjan Aqua World Underwater Zoo, Mysuru

Get ready for an exciting journey as Lokaranjan Aqua World Underwater Zoo is here. Extend your holidays in Mysuru because this place has to be on your list! The aquarium has a massive collection of freshwater as well as exotic fish. It sure is one of the most beautiful aquariums in India.

Walk through a beautiful underwater tunnel that transports you right into the ocean. It is indeed fun to watch fish glide above and beside you. What’s more? The exteriors of the aquarium depict marine life through a fish. That sure calls for photography after the visit. So, get going on the exploration journey! With many hotels in Mysore, it is easy to plan a budget-friendly getaway.

Location: 853-n-15 Zoo Garden Road, 15b, Lokaranjan Mahal Road, Indira Nagar, Ittige Gudu, Mysuru, Karnataka 570010

Aquariums in India are all about intriguing surprises in vibrant hues. Ranging from massive sharks to little koi fish, these aquariums are a treasure trove for marine enthusiasts. Now that you already have the list, select the one that best suits you!