How will you plan your travels post COVID19 pandemic? Where would you go and how would you adapt to the new normal? These questions will cross your mind before you make any travel-related decision. Safety, sanitization and proper precautions would be a major concern as opposed to destination, prices and amenities. But travel cannot be completely avoided.

Let us look at the travel trends that are likely to influence your travel post COVID19 situation.

10 Travel Trends to Stay After COVID19

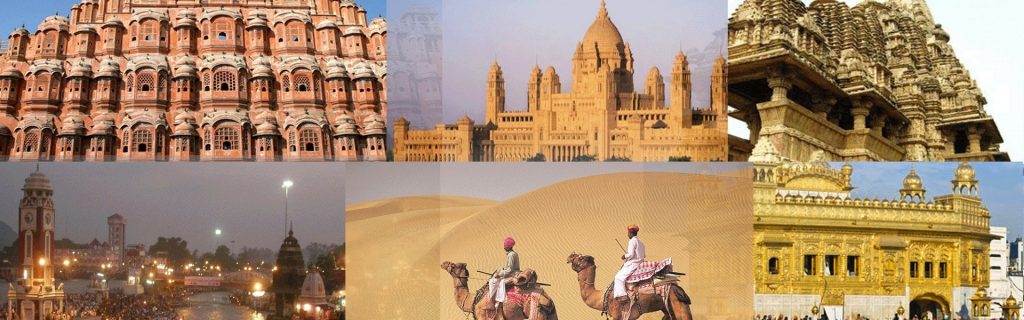

1. Domestic Travel Preferred More

It’s not a surprise if you find yourself or your friends contemplating or even postponing foreign travel. The pandemic has lead people to introspect about safe travel and safe hotel stays. With many countries allowing only sections of tourists from across the globe, domestic travel will boom better in India, or any other country for that matter. You will enjoy travelling to offbeat places in India and experiencing the new normal.

2. Country Borders Not Open for All

Crossborder travel has almost come to a standstill and may likely to remain so for a while. The recovery will take a long while as many countries will be reluctant to allow tourists from certain pockets of the globe. They would rather encourage their citizens to travel internally before opening up again for international travellers.

3. Slump in Business Travel

Business travel has experienced a huge setback and will continue to remain a low key thing for several months. High-speed internet and the comfort of closing various business deals over video calls have become the norm in this COVID19 pandemic. Businessmen who used to travel frequently to various parts of the world will now willingly shell out extra money on a good internet connection and video conferencing applications, rather than travelling to foreign lands.

4. Group Trips Will Decline

Safety will become the priority which is why there will be a huge slump in group travels. Earlier group travel was a thing mainly because it was affordable, fun and exciting. Now the situation has drastically changed. At least group travel or group trips will be limited to close family for now if at all people plan one.

5. Road Trips Would Be Preferred

Road trips are going to rule especially in the leisure travel category. People feel much safer driving in their own vehicle and visiting leisure destination of their choice. Although domestic air travel has commenced, train and inter-state bus services will begin in a phased manner, fear is a major factor that’s stopping people. Fear of taking public transport, fear of travelling with unknown people, fear of falling sick.

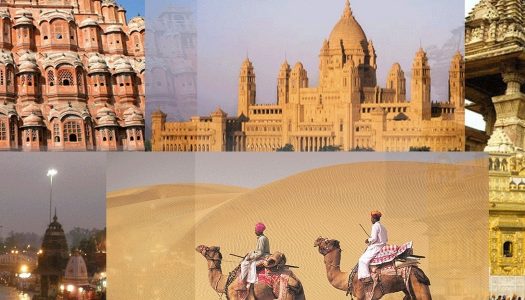

6. Destination Weddings May Be Restricted to India

Celebrities or not, Indians love hosting grand and opulent weddings abroad. European countries, beach destinations or even islands have always been a favourite for weddings. After COVID19, everything will change completely. Although destination weddings will still happen, Indians will leverage all the royal palaces and Havelis for a destination. Goa, Kerala, Udaipur, Havelock Island, Agra, Rishikesh etc. will see a surge in wedding bookings as people will settle for Indian destinations for hosting wedding ceremonies.

7. Hotel Safety Would Be a Major Concern

Trips and hotel bookings go hand in hand. Travel post COVID19 pandemic will also instil doubts and fear about hotel safety and hygiene. Whether the hotels and hotel staff follow good hygiene, sanitization process and disinfection of hotels is a question that looms large in everyone’s mind.

As a budget hotel chain, Treebo Hotels has introduced comprehensive safety standards called the Treebo Hygiene Shield which focuses entirely on all safety aspects of a stay. From completely contactless check-in/check-out to offering thoroughly sanitized rooms, in-room dining facility and prompt room service, Treebo ensures all guests experience a safe and hygienic stay across all hotels under its flagship.

8. Fewer Vacations, Longer Durations

Frequent vacations to exotic locales may not be an in-thing at least immediately after COVID19. Longer, relaxed vacations than several weekend getaways or short vacations will set in since everyone would not be comfortable leaving their house for leisure travel on a regular basis. But taking a break from the regular routine is essential for rejuvenation and mental peace and long vacations would be the preferred option.

9. Destination Working Is in Thing

Workation or destination working will gain popularity post COVID19 pandemic as people would enjoy the flexibility of working from anywhere. For more than 6 months everyone has been working from home and for the coming months too, they may not be required to physically go to their workplaces. This gives them an opportunity to relax and enjoy working from their favourite destination and also finish all tasks at their own pace.

Many hotels, like Treebo Hotels, offer amenities for guests to work from a destination. Treebo Hotels has also introduced Destination Working package at affordable prices where you can book a hotel in an exotic locale of your choice and work from there till as long as you want.

10. Flexibility for Travel

Coronavirus is here to stay for a long time but it will certainly improve flexibility in the travel sector. The uncertainty in travel plans will lead to frequent cancellations or rescheduling of trips in the eleventh hour. Airlines, hotels and every other travel-related organisations will be forced to adhere and adapt to this new normal and accommodate all changes requested by the customers.

These are the top travel trends that going to stay post COVID19 pandemic and the world will experience travel in an entirely different way. Do you agree with us? Let us know in the comments below!

[mc4wp_form id=”30734″]