Awe-inspiring sunsets, unbelievable colours of the landscapes, the tricky terrains and the satisfying feeling of setting the tent; camping in India is such a wholesome experience! Whether you think about camping in the snowy region of the Himalayas or the verdant lands of Southern India, camping in India is truly a must-try adventure. Adventure, because it takes a lot of planning and effort to get there.

As you think of the best sites for camping in India, it is important to consider your travel preferences and budget. Check out the top-rated and offbeat camping destinations in India for a memorable experience.

Camping in India: 16 popular destinations in every corner of the country

1. Rishikesh

Rishikesh is one of the finest places for camping in India. As the holy river Ganga flows through Rishikesh, it attracts thousands of tourists every year. Apart from its religious importance, Rishikesh is known for its wonderful views and camping experiences. You can find affordable tents to luxury cottages here.

Shivpuri is a popular area as it is home to huge camping grounds. What’s more? Waking up to the flowing river elevates your camping experience. Abundant flora, unpolluted air and local food enhance your time here. You can always check for affordable hotels in Rishikesh to rest before the adventure begins.

2. Spiti Valley

How can you miss one of the amazing places for camping in India? Located in the heart of Himachal Pradesh, Spiti Valley is a paradise for travellers and adventure seekers. You can find many camping sites perched on the hilltop with the view of clear skies. What makes camping in Spiti Valley special is the adrenaline rush.

One night you’re witnessing the Milky Way and the next morning, you’re covered with the golden rays of the sun hitting the mountains. Camping in Spiti comes with home-cooked meals and minimal facilities. It is best recommended to train yourself with acclimatisation. You can camp at Aphu, Chitkul, Nako, Losar, Chandratal and Sangla.

3. Tso Moriri Lake, Ladakh

Tso Moriri is one of the largest lakes in India located in Ladakh. It attracts thrill seekers due to its expansively beautiful landscape. Camping in India is truly exciting at Tso Moriri Lake. It is because there are multiple tent options and cottages to stay in.

Moreover, you get to enjoy the scenic views of the lake combined with homely meals. Since it is not very crowded, you mostly have the place to yourself. It is super important to check for the tent facilities as Ladakh experiences extreme cold weather.

Wondering what more you can do here? Head to the serene monasteries in Ladakh for the rhythmic chants and calmness.

4. Manali

Manali is the ultimate trip destination for adventure and exploration. Being one of the best places for camping in India, Manali attracts all types of travellers. Camping here is easier than in the high-altitude places in the Himalayas. With so many camps by the Beas River, you can select any one that best suits your requirements.

You get to choose from moderately priced to luxury tents here. Along with this, you can opt for river rafting and paragliding. There are many camping areas in the hilly regions as well. Homely meals made with Himachali spices are sure a highlight. It is ideal to book affordable hotels in Manali before the adventure for a fun-filled getaway.

5. Jaisalmer

You must have heard of all types of camping in India. However, desert camping is one of the best ways to explore the dunes. Jaisalmer invites you for a culturally rich camping experience. The chilly desert areas get even colder during the winter months. It calls for a soothing bonfire clubbed with fritters and tea.

Camping here exposes you to the traditional folk dance and music right outside the tents. Staying in the tent also comes with the convenience of great services, delicious meals and high-end facilities. Moreover, you can also book hotels in Jaisalmer to explore the main city.

6. Anjuna Beach, Goa

Known for its sandy coastline, Goa is indeed one of the offbeat places for camping in India. Anjuna Beach is a great place for setting up tents and watching the beach waves. This beach camping experience again is a convenient option as you get scrumptious meals and great amenities.

Surrounded by natural beauty, it is easy to say that Anjuna is a hot spot for tourists. With a bonfire and music, your experience is sure to elevate. Check for areas with lesser shacks allowing you to set up your tents. What’s more? You can find the best hotels in Goa near the popular beaches for a comfortable stay.

One day is never enough for this beautiful destination. A 4-day Goa itinerary is sure to satisfy your thirst for adventure and exploration.

7. Kutch

A wholesome camping experience awaits you in the heart of Gujarat. Kutch is one of the best places for camping in India. Known for its white desert, Kutch is home to many camping sites. It is again diving into a culturally rich time. You get to see the hospitality of Gujarat with delicious meals, traditional performances and amazing facilities.

Camel safari is a popular thing in Kutch. Moreover, the government has taken various initiatives to set up affordable tents for all types of travellers. The tents here are equipped with comfortable bedding, bathrooms and heater facilities. You can also stay in a traditional Bhunga while camping in Kutch.

8. Bhimtal

Bhimtal, in Nainital, is one of the most thrilling places for camping in India. Moreover, this place is known for luxurious campsites in proximity to nature. Tea gardens and peach orchards offer a memorable experience. You can also find many campsites amidst the pine forests. Many of these expeditions also include forest walks and nature trails.

What’s more? Some sites also have access to swimming pools. Most of the activities include a double rope walk, commando net and Burma bridge. A campfire with delicious meals and music is what makes your camping experience fun!

9. Pushkar

Popular for its camel festival, Pushkar is one of the bustling places for camping in India. Here is another desert camping option if you are looking for something unique! Camping here features authentic Rajasthani food, traditional music, folk dance and connecting with locals.

As the sun sets, the sand turns colder thereby elevating the winter charm. That’s when the golden-orange flames of the bonfire keep you warm. With soothing music and loved ones around, you truly witness the joy of camping in Pushkar. You can also find many affordable hotels in Pushkar in the city area for a great time.

Take home souvenirs from this city of Rajasthan. The best shopping places in Pushkar are a vibrant affair for tourists.

10. Munnar

Hey, can you sense the tantalising aroma of tea leaves? Because Munnar is home to some of the largest tea plantations in India. As you think of camping in India, Munnar is always ready to greet you. With the mesmerising views, the city has many campsites on hilltops. A bit of trekking and there you are, sighting your vision at the magic of nature.

Away from the chaos, many campsites have access to waterfall areas and jungle trails. The experience elevates during the winter season when the skies turn all blue as if it’s a canvas to paint on! Facilities are commendable and you can expect good food too! So, book comfortable hotels in Munnar for shopping in the city area.

11. Coorg

Coorg offers a fusion of stimulating adventures and relaxation. It is one of the ideal places for camping in India due to its lush greenery. Tourists love to explore the many hidden places for camping here. While there are many camps, you can also find a few eco-camps. While some camps have access to a swimming pool, others offer basic services.

You might also need to trek to reach the top of hillside camps. What’s more? Many camping areas have access to jungle trails and waterfalls thereby elevating your experience. It is best to book budget-friendly hotels in Coorg before or after your experience for an ideal exploration.

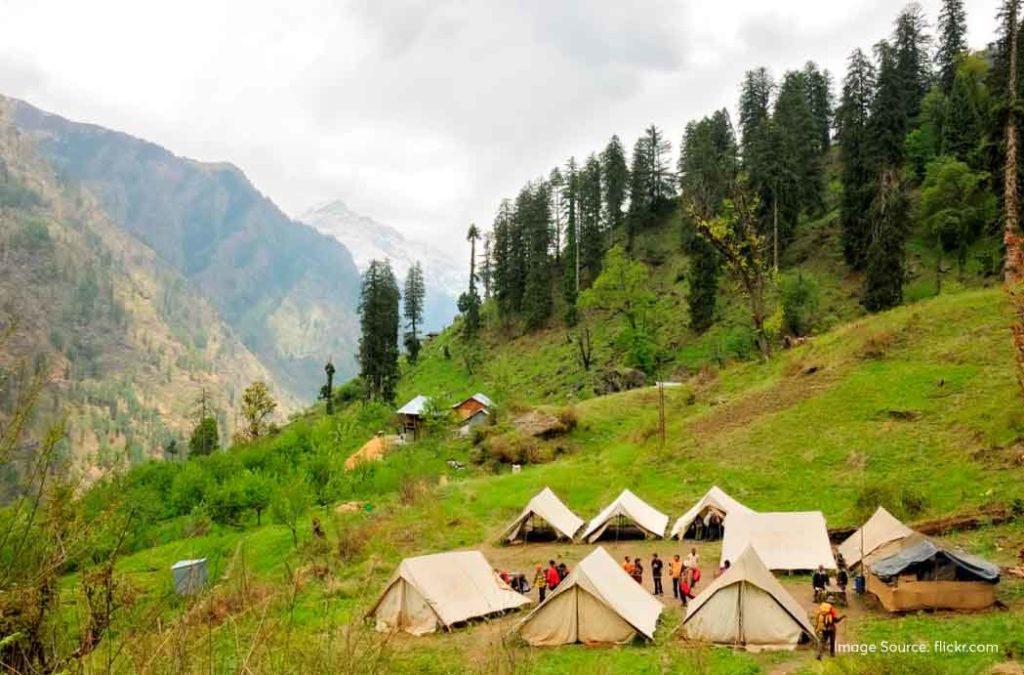

12. Kasol

Kasol is a one-stop destination for serene camping in India. Whether you are looking for riverside or hilltop camping, Kasol has everything! There are a plethora of camping sites suiting your preferences. Most of the campsites are well-developed due to extreme tourism. This is why you can expect mouth-watering food, good facilities, amazing hospitality and well-trained staff.

As you disconnect from the chaos, the camping here takes you closer to the natural beauty of the hills. Campfire, music and comfortable seating areas are a highlight when camping in Kasol. Lastly, you also get an opportunity to connect with locals and witness their heartwarming love for tourists.

After a thrilling camping time, check out the best places to visit in Kasol for a memorable getaway.

13. Kullu

Kullu is your adventure destination for camping in India. The city offers lakeside as well as jungle camping. Imagine walking on the endless landscape of green with blue skies above you! Since Kullu is a famous place, you can expect well-designed tents and moderate services here. Some of the campsites also offer zip-lining adventures.

You need to trek towards the top for camping in the hilly areas. The experience is all worth it as the weather remains pleasant throughout the year. With affordable hotels in Kullu, it is best to opt for a great stay to relax with your loved ones.

14. Sonamarg

Nestled in the heart of Jammu and Kashmir, Sonamarg is one of the most beautiful places for camping in India. Here, you can camp by the riverside or even on the hilltop. The awe-inspiring views of the valley are sure to melt your heart. There are many campsites ranging from affordable ones to luxury cottages.

Since the camping areas are located near villages, you can walk through the villages too. Kashmiri food and hospitality are the highlights of camping in Sonamarg. As the sun sets, the campfire illuminates your time with loved ones. You can also go for adventure activities including river rafting and zorbing nearby.

15. Wayanad

If adventure fills your soul, Wayanad is for you! Offering thrilling trekking and verdant landscapes, Wayanad is one of the best places for camping in India. There are many camping sites in the hilly areas as well as comfortable campgrounds. Jungle camps are also a thing as Wayanad is known for its exotic wildlife.

Some campsites require you to trek towards the top. Most of the camping places offer rock climbing, carrom, giant hammock and tyre walking. What’s more? The authentic Kerala-style food with delicious filter coffee. Book affordable hotels in Wayanad’s city area for shopping and exploration.

The city has so much more to offer! With the top places to visit in and around Wayanad, you can make amazing memories with your loved ones.

16. Dawki River

Being one of the underrated places for camping in India, Dawki River is rather a gem! You must have camped in the best of places. However, imagine the feeling of facing huge trees forming a massive mountain in front of you. That’s exactly about camping near the Dawki River.

Situated in Meghalaya, the Dawki River is known for its crystal-clear waters. Winter months are ideal for camping. Boating and cliff jumping are the best adventures to try. What’s more? The experience is topped with lovely locals and home-cooked meals. The facilities are basic and for the ones who want to be around the natural cover. It is ideal to book hotels in Shillong as it is the nearest city.

Camping in India is indeed an experience of adventure, thrill and excitement! As you visit these places, be ready with your camping gear and a lively spirit.