Aurangabad, one of the highly populous cities of Maharashtra, is a famous tourist hub that attracts thousands of visitors from across the country. Famously known as the “City of Gates”, Aurangabad got its name from the erstwhile Mughal Emperor Aurangzeb who made this city the capital during his reign. Aurangabad is home to several prominent tourist sites and is also situated very close to Ajanta and Ellora Caves, the UNESCO World Heritage Sites since 1993.

The city is dotted by several resplendent Mughal architectures, prominent among them being Bibi ka Maqbara, that have stood the test of time and still marvel the onlookers who visit these places. Aurangabad is also a brimming hub of exquisite silk and handwoven outfits, loved and sought after by the locals and the tourists alike. To truly embrace the rich history and culture of this city, let’s take a look at the top places to visit in Aurangabad.

15 Amazing Places to Visit in Aurangabad

1. Bibi ka Maqbara – Mausoleum of Aurangzeb’s Wife

Bibi ka Maqbara, Aurangabad

If Taj Mahal in Agra is an architectural wonder erected by Shah Jahan, then Bibi ka Maqbara is one of the most important places in Aurangabad, created by the last Mughal Emperor Aurangzeb. Bibi ka Maqbara is also a monument symbolic of Aurangzeb’s love for his wife DilrasBanu Begum. Built using pristine marble and embellished with intricate designs and carvings, this is one of the largest structures created during Aurangzeb’s reign and was supposed to be a rival of the mighty Taj Mahal. A popular attraction in Aurangabad, this incredible monument attracts history buffs, tourists, photographers and others to admire its architectural beauty with the backdrop of a brilliant landscape.

- Visiting Time: 8 AM to 8 PM

- Entry fee: None

You can also read about 20 Iconic Monuments in India that You Must Visit

2. Aurangabad Caves – Beautiful Caves in Aurangabad

One of the major attractions in Aurangabad, Aurangabad Caves are a total of 12 Buddha shrines that are located a few kilometres from Bibi ka Maqbara. Aurangabad Caves are sixth or seventh-century caves spectacularly carved out of soft basalt rock. They are divided into three groups and are spread away from each other. TThese caves are now maintained by the Archeological Survey of India. You can easily cover the Aurangabad Caves and other tourist places nearby in a single day.

3. Siddarth Garden – Enjoy the Green Surroundings

Siddarth Garden, Aurangabad

A perfect choice for sightseeing and relaxation, Siddharth Garden is one among the many great places to visit in Aurangabad with family and friends. Encompassing a lush, green garden as well as a zoo, Siddarth Garden is conveniently located close to both Aurangabad Station as and the popular monument, Bibi ka Maqbara and can be easily reached. While you can spot some exotic species like crocodiles, elephants, tigers, reptiles and more, watching the wide variety of flowers, trees and plants in the garden will also give you calm and solace. Siddarth Garden also has an aquarium with many fish varieties that you can watch while visiting this place.

- Visiting time: 9 am to 7 pm

- Entry Fee: Garden – Rs20 per person; Zoo – Rs50 per person

4. Panchakki – Ancient Water Mill in Aurangabad

Panchakki, Aurangabad

Panchakki or the water mill is a unique site that must feature in your list of Aurangabad tourist places as this interesting site offers both a glimpse into the science and technology used during the medieval era and an amazing view of the beautiful surroundings in different hues. It is also one of the popular attractions in Aurangabad along with other important sites. The main purpose of building this mill was to supply water through the underground earthen pipes that fetch water from a nearby tributary and generate energy to run the mill and grind grains to feed the pilgrims who come to visit the Baba Shah Musafir Dargah.

5. Salim Ali Lake – Calm and Tranquil Bird Spotting Place

Salim Ali Lake, Aurangabad

If you love to spend an evening watching colourful birds chirping their heart away, sitting near a pristine lake to soak in the natural beauty of the surroundings, Salim Ali Lake or Salim Ali Sarovar is the best tourist attraction in Aurangabad to go to. Situated centrally in Aurangabad, this beautiful lake that is also an abode to many species of birds has been named after a famous Ornithologist and is one of the best places in Aurangabad to hang out with friends and family. The best time to visit the Salim Ali Lake will be in the morning since one can watch a spectacular sunrise and also hear the birds chirping.

- Visiting time: 8 am to 5 pm

- Entry Fee: Free Entry

6. Jama Masjid Aurangabad – Seventeenth-Century Mosque

Jama Masjid is one of the oldest mosques in Aurangabad built in the seventeenth century and is also one of the important places to visit in Aurangabad, Peace and tranquillity washes over you while praying or watching people pray in this mosque. The impeccably designed arches, tall minarets, around 50 polygonal pillars and other structures of the mosque showcases the architectural genius of the Mughals. The mosque is now maintained under the Archaeological Survey of India.

- Visiting Time: Always Open

- Entry Fee: Free Entry

7. Dargah of Pir Ismail – In Memory of Aurangzeb’s Tutor

Among all Aurangabad tourist places, Dargah of Pir Ismail is an important place to visit for those who love to learn and understand this mesmerizing city’s history. Dargah of Pir Ismail, as the name suggests, is dedicated to the Sufi Saint Pir Ismail who tutored the Mughal Emperor Aurangzeb during his childhood. The Dargah consists of a parapet, facade, dome and a terrace and the tomb showcases a beautiful blend of Pathan and Mughal architecture. This Dargah is particularly flocked by locals and tourists on Thursdays. Do not miss visiting this amazing structure during your Aurangabad tour!

- Visiting Time: 5 am to 8 pm

- Entry Fee: Free Entry

8. Goga Baba Tekdi – Tranquil Place for a Quick Getaway

Goga Baba Tekdi, Aurangabad

A beautiful hilltop that promises you with a scintillating panoramic view of Aurangabad, Goga Bab Hill wins the top spot among amazing places to visit in Aurangabad. The green hilltop dotted with innumerable trees is a favourite spot among tourists, nature lovers, photographers and others to witness a brilliant sunset and also take a tour around to explore the hilltop. There is a small temple as well situated at the foot of this hill that one can visit, if interested. Goga Baba Hill is definitely a charming getaway to spend some time with nature.

9. Hazur Sahib Nanded – Famous Sikh Pilgrimage in Aurangabad

Hazur Sahib, also known as Abchalnagar or Takht Hazuri Sahib Sachkhand, is an important pilgrim site of the Sikhs as it houses one amongst the five Takhts of Sikhism. Sikh Guru, Guru Gobind Singh attained the holy abode in this location which is why Hazur Sahib Nanded is one of the most significant places to visit in Aurangabad and is flocked by Sikh devotees all over the year. The stunning architecture of the Gurudwara will awe you and the warm and welcome ambience of this holy place is immensely humbling. People from all walks of life, all religions are allowed to visit the Gurudwara.

- Visiting Time: All through the day

- Entry fee: None

10. Soneri Mahal – Palace in Aurangabad

Soneri Mahal, Aurangabad

Soneri Mahal is technically the last remaining palace in Aurangabad that is still a stunning example of the Rajput style architecture. This historical palace got its name owing to the gold paintings that once adorned the interiors of this place. Today, this palace is home to a museum that stores the antiques, ancient sculptures, pottery and household items of the Rajput era. Soneri Mahal is also the place where the Ajanta and Ellora Cave festivals are organised each year and prominent artists, dancers and musicians are invited for performing. Indeed, Soneri Mahal is one of the most magnificent places to visit in Aurangabad.

- Visiting Time: 9 am to 5 pm

- Entry fees: INR 10 per person

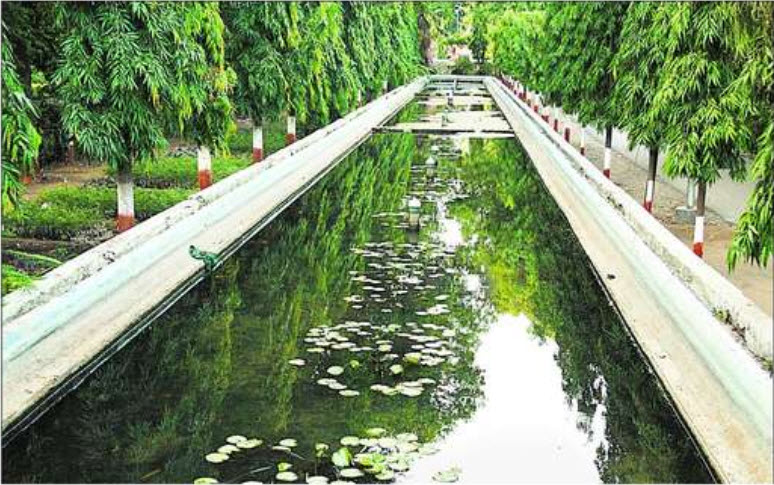

11. Himayat Bagh – Seventeenth-Century Garden in Aurangabad

Himayat Bagh, Aurangabad

A charming garden of the 17th century built on a sprawling 400-acre land, Himayat Bagh is one of the important, incredible places to visit in Aurangabad. The garden houses rows of trees, a pool and a nursery with a wide variety of flora. If you wish to relax and enjoy some time in a calm and serene place, Himayat Bagh is a great choice during your tour to Aurangabad. You can also check out the different saplings displayed in the nursery and purchase plants of your choice.

- Visiting Time: The entire day

- Entry fee: None

12. Shivaji Maharaj Museum – Preserving the Artifacts of the Maratha Empire

Shivaji Maharaj Museum, Aurangabad

Created in the honour of the famous Maratha ruler Chhatrapati Shivaji Maharaj, Shivaji Maharaj Museum is an enchanting museum and famous Aurangabad tourist places as well. The museum houses the astounding artefacts of the Maratha EMpire including a traditional Paithani saree, 500-year-old armour and a copy of the Holy Quran that Aurangzeb had written during his reign. Shivaji Museum is one of the highly recommended places to visit in Aurangabad for those who love to delve deep into the history and architectural significance of a place.

- Visiting Time: 10 am to 6 pm

- Entry fees: INR 50 per person

13. Gul Mandi – Biggest Market of Aurangabad

If you love shopping at the local bazaars of a tourist site that you visit, Gul Mandi is a place that you must not miss visiting. The largest Bazaar in Aurangabad, Gul Mandi is famous for selling Himroo shawls and sarees that are intricately designed using inspirations from the paintings of Ajanta and Ellora Caves, peacocks and flowers. It is also famous for Paithani sarees that are sold exclusively in this bazaar. You can purchase a great variety if this fabric from the Gul Mandi and gift it to your loved ones as well.

- Visiting Time: 10:30 am to 9 pm

- Entry Fee: Free Entry

14. Bani Begum Garden – Enchanting Garden with Lush Greenery

Bani Begum Garden gets its name from Aurangzeb’s daughter-in-law Bani Begum and is a picturesque garden with lush greenery and the domes and pillars of the Mughal era. The garden also has beautiful fountains and houses the tomb of Bani Begum as well. The green swaying trees coupled with the remnants of Mughal architecture in the form of the tomb, dome and pillars make Bani Begum Garden one of the finest places to visit in Aurangabad.

- Visiting Time: 9 am to 6 pm

- Entry Fee: Free Entry

15. Grihneshwar Temple – Jyotirlinga Temple

Grishneshwar Temple, Aurangabad

Another UNESCO World Heritage Centre, Grishneshwar Temple is also a holy abode to one of the 12 Jyotirlingas in India. It is a 13th-century Shiva Temple that was destroyed by the Mughals and twice re-built after the end of the Mughal Era. The temple portrays South Indian Temple architectural style and is one of the oldest temples in Aurangabad, which makes it a significant part of Aurangabad tourist places as well. This temple is located in Ellora.

- Visiting Time: 5 AM to 9 PM

- Entry fee: None.

Here is the list of Aurangabad tourist places that you must include in your Aurangabad sightseeing itinerary. From the oldest mosque to the oldest temple, Aurangabad houses structures of great historical and religious significance. If you are planning a trip to this place, do include all the places to visit in Aurangabad from this list and enjoy exploring the ancient city in Maharashtra. If you are looking for comfortable hotels here, book your stays with hotels in Aurangabad.